In the first nine months of this year, new orders received by Chinese shipbuilders accounted for 58.3% of the world market share, and orders in the hands of shipyards also accounted for 48.3% of the global share, ranking first in the world.

In the first nine months of this year, new orders received by Chinese shipbuilders accounted for 58.3% of the world market share, and orders in the hands of shipyards also accounted for 48.3% of the global share, ranking first in the world.

China replacing the US to become largest trade partner of the EU in Q3 is good news for both China and the EU, reflecting resilience and potential bilateral economic and trade relationship.

The coronavirus pandemic has reshuffled the international air travel market, and Shanghai has replaced London as the world’s largest hub, the latest report released by the International Air Transport Association showed.

Shanghai is now the top-ranked city for connectivity with the top four most connected cities all in China – Shanghai, Beijing, Guangzhou and Chengdu.

The report said London, the world’s number one most-connected city in September 2019, has seen a 67 percent decline in connectivity. By September 2020, it had fallen to number eight. The report also said New York (-66 percent fall in connectivity), Tokyo (-65 percent), Bangkok (-81 percent), Hong Kong (-81 percent) and Seoul (-69 percent) have all exited the top ten.

VISION 2040 from this year’s APEC includes:

-Trade & Investiment: reaffirm support for rules of WTO in multilateral trading system -Innovation & Digitalization: strengthen digital infrastructure, accelerate transformation, narrow digital divide, cooperate to facilitate data flow.

APEC PUTRAJAYA VISION 2040

Our Vision is an open, dynamic, resilient and peaceful Asia-Pacific community by 2040, for the prosperity of all our people and future generations.

Remaining committed to APEC’s mission and its voluntary, non-binding and consensus-building principles, we will achieve this Vision by pursuing the following three economic drivers:

Trade and Investment: To ensure that the Asia-Pacific remains the world’s most dynamic and interconnected regional economy, we acknowledge the importance of, and will continue to work together to deliver, a free, open, fair, non-discriminatory, transparent and predictable trade and investment environment. We reaffirm our support for agreed upon rules of the WTO in delivering a well-functioning multilateral trading system and promoting the stability and predictability of international trade flows. We will further advance the Bogor Goals and economic integration in the region in a manner that is market-driven, including through the work on the Free Trade Area of the Asia-Pacific (FTAAP) agenda which contributes to high standard and comprehensive regional undertakings. We will promote seamless connectivity, resilient supply chains and responsible business conduct.

Innovation and Digitalisation:To empower all our people and businessesto participate and grow in an interconnected global economy, we will foster an enabling environment that is, among others, market-driven and supported by digital economy and innovation. We will pursue structural reforms and sound economic policies to promote innovation as well as improve productivity and dynamism. We will strengthen digital infrastructure, accelerate digital transformation, narrow the digital divide, as well as cooperate on facilitating the flow of data and strengthening consumer and business trust in digital transactions.

Strong, Balanced, Secure, Sustainable and Inclusive Growth: To ensure that the Asia-Pacific region is resilient to shocks, crises, pandemics and other emergencies, we will foster quality growth that brings palpable benefits and greater health and wellbeing to all, including MSMEs, women and others with untapped economic potential. We will intensify inclusive human resource development as well as economic and technical cooperation to better equip our people with the skills and knowledge for the future. We will promote economic policies, cooperation and growth which support global efforts to comprehensively address all environmental challenges, including climate change, extreme weather and natural disasters, for a sustainable planet.

To maintain APEC’s unique position as the premier forum for regional economic cooperation as well as a modern, efficient and effective incubator of ideas, we will embrace continuous improvement of APEC as an institution through good governance and stakeholder engagements. We will advance the APEC Putrajaya Vision 2040 with a spirit of equal partnership, shared responsibility, mutual respect, common interest, and common benefit. We will achieve the Vision by 2040, with an appropriate implementation plan and review of its progress.

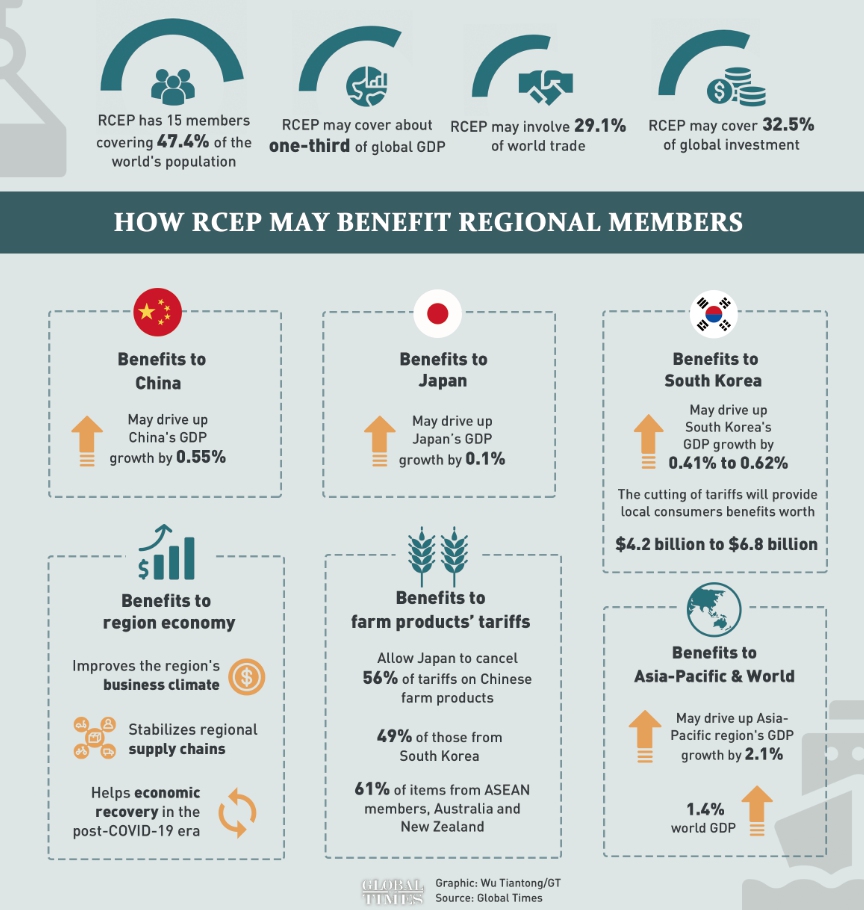

China and 14 Asia Pacific economies (Indonesia, Malaysia, Philippines, Thailand, Singapore, Brunei Darussalam, Cambodia, Laos, Myanmar, Viet Nam, Japan, Korea, New Zealand, Australia) on Sunday officially signed the RCEP, which is said to be the world’s largest trade pact, in a virtual ceremony. The signing of the RCEP would help the Asia Pacific region take the global lead in recovering from the COVID19 pandemic and reduce US hegemony in the region.

The deal will create what is believed to be the world’s largest free trade zone, covering about one-third of the world’s total population and GDP. It will be also Japan’s first free trade framework with its vital trading partners China and South Korea.

Offshore duty-free sales in South China’s Hainan Province reached 10.85 billion yuan ($1.63 b) from Jul 1 to Oct 19, up 218.2% y-o-y despite the COVID19 impact. In Jul 1, Hainan raised its annual tax-free shopping quota to 100,000 yuan per person from 30,000 yuan.

Hong Kong retail sales drop 13 per cent in August, continuing 19-month downward spiral.

Official figures show consumer spending shrank for the 19th straight month, to HK$25.6 billion. Sales in 2020 so far are nearly a third lower than in the same eight-month period last year.

https://edition.cnn.com/2020/10/19/investing/premarket-stocks-trading/index.html

China’s economy expanded by 4.9% in the third quarter compared to the previous year, according to government data published Monday, showing the rest of the world what’s possible when Covid-19 is brought under control.The pace of growth was a tad slower than economists had expected. But there were plenty of signs of strength, with the services and construction sectors performing especially well.China’s economy has now recovered from its historically bad first quarter, when the coronavirus forced the country to shut down. GDP grew a cumulative 0.7% through the first nine months of 2020, the data show. The best is yet to come.

The Made-in-China model 3 vehicles are ready to leave the port in Shanghai next Tuesday to be exported to Germany, France, Italy and other European countries, although CEO Elon Musk said the company did not plan to export when building its Gigafactory in Shanghai.

In the near future, Tesla hopes the Made-in-China vehicles can benefit global consumers not only through China manufacturing but China design, research and development, Song Gang, manufacturing and operations head of Tesla’s Gigafactory in Shanghai said, according to media reports on Monday.

Auto analysts tied the reason for exports to robust capacity at the Shanghai factory, competitive costs of “Made-in-China” products, and the complete supply chain in the Chinese auto sector.

Tesla is not alone. BMW and Polestar are making electric vehicles (EVs) in China and selling them to Europe.

China drew bumper demand for a dollar bond sale amid growing uncertainties over the U.S. elections and tensions with Washington.

The Ministry of Finance opened up its bond sale to a broad pool of U.S. investors for the first time, potentially diversifying its investor base and setting aside concerns of decoupling in credit markets.

The deal includes China’s debut issuance of 144A notes, as well as previously sold Regulation S senior bonds, allowing participation from a wider range of potential international investors compared to last year’s jumbo global offering of $6 billion dollar bonds and 4 billion euro notes ($4.7 billion).