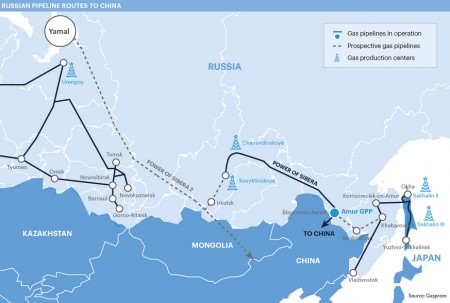

China officially began the world’s largest tunnel construction under a major river on Tuesday, kick starting the construction of the 1,509-kilometer-long southern Chinese section of the China-Russia east-route natural gas pipeline.

The tunnel under the Yangtze River is a key project of the southern Chinese section of the pipeline, which will connect Yongqing in North China’s Hebei Province with the economic hub of Shanghai.

The China Oil & Gas Piping Network Corporation, the national oil and gas pipeline company launched late last year, said that after the key project is completed by June 2025, annual throughput will reach 18.9 billion cubic meters per year.

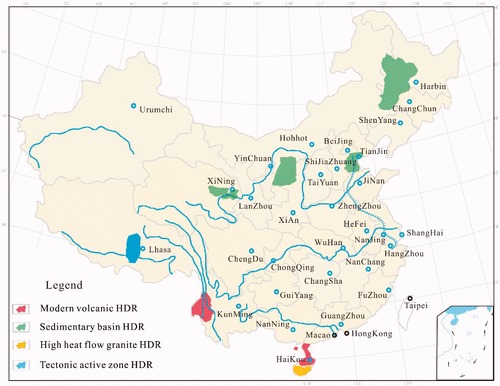

Energy traffic in the Yangtze River Delta will be immensely improved, with imported Russian natural gas meeting civilian and industrial demand in the region, the company said.